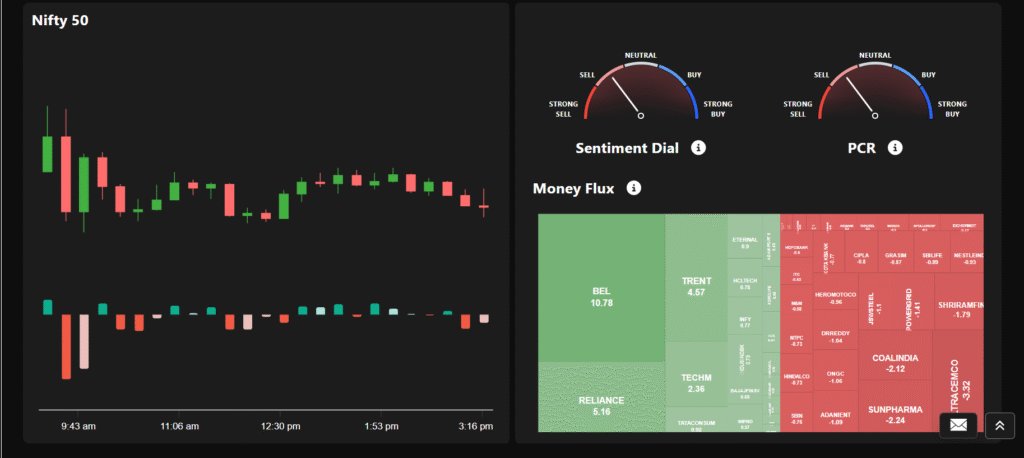

The Nifty 50 top gainer and loser today reflect the contrasting narratives unfolding in India’s dynamic stock market. On April 29, 2025, the benchmark Nifty 50 index closed almost flat at 24,335.95, gaining just 7.45 points. But beyond the calm surface, individual stocks saw significant action. Leading the charge upward was Trent Ltd, while Sun Pharma found itself under pressure.

Here’s a detailed breakdown of these key movers.

📈 Nifty 50 Top Gainer Today: Trent Ltd

- Closing Price: ₹5,391.50

- Gain: ₹182.00 (+3.49%)

Trent Ltd, the retail powerhouse from the Tata Group, claimed the title of Nifty 50 top gainer today. Its strong 3.5% rally came on the back of increasing investor optimism surrounding India’s booming retail sector.

Why Trent Is Gaining Investor Confidence

Trent’s business strategy revolves around scalable retail models like Westside and Zudio, which have rapidly expanded across urban and semi-urban India. Zudio’s value-focused fashion offering is resonating well with budget-conscious customers, particularly in tier-2 and tier-3 cities.

Another factor supporting the stock’s momentum is consistent performance in recent quarters. The company has reported strong same-store sales growth and a healthy profit trajectory. In addition, there’s a broader bullish sentiment toward Indian consumer stocks, especially those with strong brand equity and distribution networks.

Expert Take

Many analysts expect Trent’s growth story to continue, buoyed by domestic consumption trends and its efficient retail rollout. Several brokerages have upgraded the stock’s price target, citing its potential to scale even further with minimal debt exposure.

👉 Read Trent’s Q4 financials here

📉 Nifty 50 Top Loser Today: Sun Pharma

- Closing Price: ₹1,170.95

- Loss: ₹28.75 (-2.39%)

On the flip side, Sun Pharmaceutical Industries Ltd, India’s leading pharmaceutical company, ended as the Nifty 50 top loser today. The stock declined over 2% amid concerns about regulatory risks and pricing pressure in its largest market — the United States.

Why Sun Pharma Is Under Pressure

According to industry sources, one of Sun Pharma’s facilities may be facing regulatory scrutiny, which could result in a delay in product approvals. The USFDA has historically been strict with Indian pharmaceutical plants, and even minor infractions can lead to significant business implications.

Adding to this, the US generics market continues to experience pricing erosion, impacting profit margins for Indian pharma exporters. Some investors also appeared to book profits ahead of Sun Pharma’s upcoming quarterly earnings announcement.

Market View

Despite today’s dip, analysts remain divided. Some see the current weakness as a short-term phase, while others urge caution until regulatory clarity emerges. The long-term fundamentals remain solid, but near-term volatility may persist.

👉 Check latest news on Sun Pharma here

📊 What This Means for Investors

The movement of the Nifty 50 top gainer and loser today illustrates how sectoral dynamics and company-specific factors can influence stock prices, even when the overall market remains range-bound.

- Retail stocks like Trent are benefiting from consumption-driven growth and brand strength.

- Pharma stocks like Sun Pharma are vulnerable to external regulatory and pricing risks.

For retail investors, this offers a valuable lesson: market-neutral days can still present big opportunities — and risks — in individual counters.

Read more on: 👉 Is Trading a Good Career in India?

If this article helped you, please share it with friends or family who are considering a trading career. It might help them make a better decision or avoid costly mistakes.

Stay safe, trade smart.

![What is Option Chain with Greeks? [Top 2025 Guide for Beginners]](https://dailybullshot.com/wp-content/uploads/2025/04/ChatGPT-Image-Apr-27-2025-10_08_39-AM.png)

![Top 5 Best Technical Indicators for Day Trading Beginners [Complete Guide]](https://dailybullshot.com/wp-content/uploads/2025/04/ChatGPT-Image-Apr-26-2025-04_57_29-PM.png)

Leave a Reply